- Home

- Bankruptcy

- Rebuilding Credit After Bankruptcy

Rebuilding Credit After Bankruptcy 7 Brilliant And Incredibly Easy Tips!

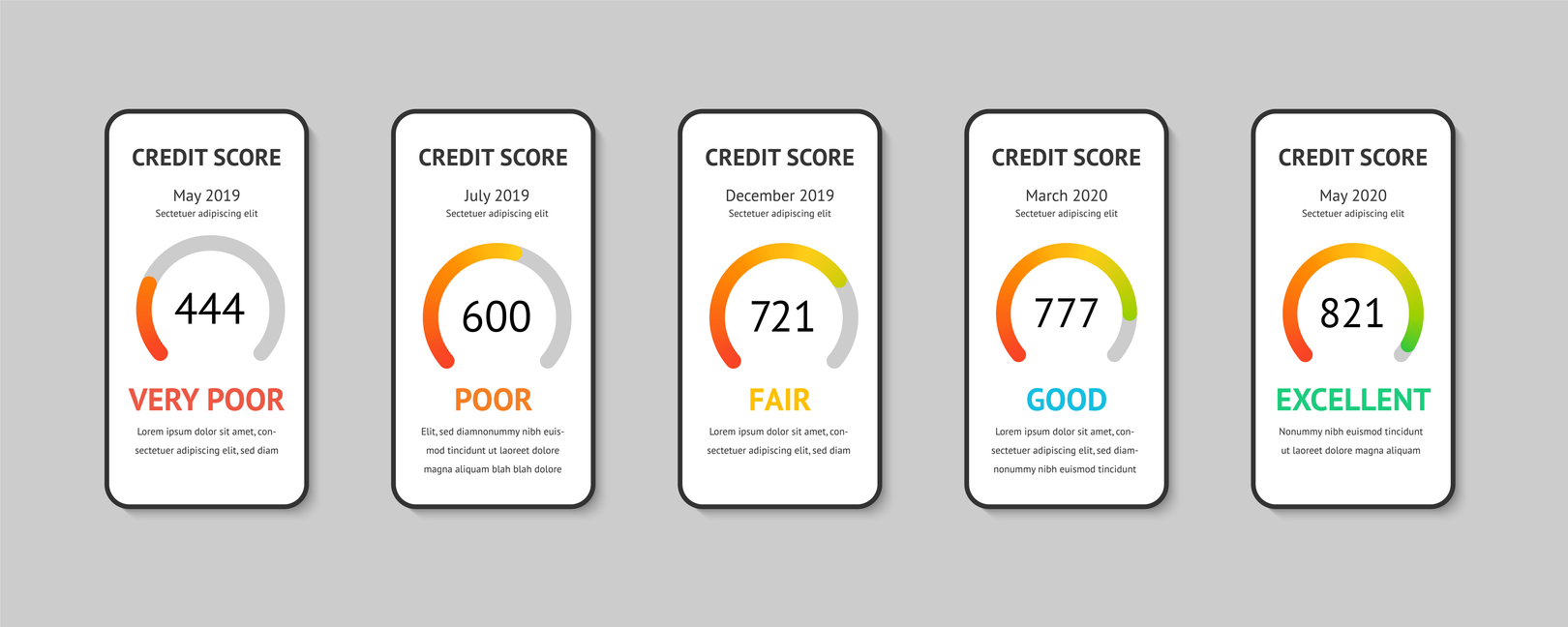

Rebuilding credit after bankruptcy is possible. It's a public record that stays on your credit report for 7 to 10 years. But you don't have to wait that long. A big misconception about bankruptcy is that you could ruin your credit forever by filing for bankruptcy.

This myth discourages and delays people from filing for bankruptcy.

This information is for the individuals who struggle to pay debts but are worried about how bankruptcy could affect their credit rating. Rebuilding my credit after bankruptcy can be done in time.

The two major types of bankruptcies that affect individuals are; chapter 7 bankruptcy, which can stick around for ten years, and chapter 13 bankruptcy, which may drop off after seven years.

If you have not made your debt payments on time, you may already have a low FICO score and bad credit. Missed payments will only worsen your credit score and will not allow you to start over anytime soon, but filing bankruptcy can help you start over.

Is Filing Bankruptcy To Improve Your Credit Score A Possibility?

Rebuilding credit after bankruptcy by filing bankruptcy is more straightforward than trying to improve your credit score after long periods of late and missed debt payments.

But, it does not just happen overnight. Besides, there's a catch, when you file for bankruptcy, you're telling the world that you're broke and unable to pay your debts because of the poor financial decisions you have made in the past.

With bankruptcy, your financial past is a public record and will stay on your report for up to ten years. So you might want to review the pros and cons of filing for bankruptcy before you take that leap.

Rebuilding Credit After Bankruptcy 101.

You will need to take charge of your credit report and calculate your steps towards rebuilding your credit after your bankruptcy has been discharged.

Here are two simple ways to start preparing for rebuilding credit after bankruptcy:

1. Make A Budget & Adhere To It

Your expenditures should not exceed your income. To achieve this, create a budget that you can keep. Making a budget that you can abide by is not a simple task and will require planning.

Although it is hard to stick to a budget, you can do it! If you practice more. It is easier to stick to your monthly budget if you only spend on utilities, rent, and other fixed expenses.

The problem with staying on track with a budget arises when you include discretionary expenses like entertainment, gas, and groceries. For these types of expenditures, you should trace every dime.

Tracking every dime is especially crucial if you plan to adhere to a budget. After some time, you get used to it.

2. Include An Emergency Fund In Your Budget

When you draft your budget, an emergency fund should be listed along with your expenses. Incorporating an emergency fund in your budgeting account can be a great way to channel some of your income into an emergency fund.

An emergency fund will back you up financially and cushion you during hard times. If something unexpected comes up, you do not have to take money out of your budget.

Do you still have pressing questions regarding how rebuilding credit after bankruptcy works? Continue reading.

Seven Easy Steps From Experts For Rebuilding Credit After Bankruptcy!

(1) Keep Pace With Any Debts That Made It Through The Bankruptcy Filing

Your bankruptcy may not cover some debts. For example. Alimony, student loan debts, and tax debts. Bankruptcy cannot erase non-dischargeable debts, and you have to pay them to prevent your credit from plummeting even further.

Making timely payments on non-dischargeable debts is the first step towards rebuilding credit after bankruptcy.

Having several non-dischargeable debts can somewhat be hard on your credit report, so you should not ignore them. Try repaying your student loans or apply for a repayment plan based on your income. For tax liens, gradually pay them off through installments that you can negotiate with the IRS.

(2) Have Someone Else Make You An Authorized User On Their Credit Card Account

Having someone else like a close friend or a relative list you as an authorized user on their credit card is ideal for rebuilding credit after bankruptcy. Suppose the person who makes you an authorized user on their credit card has a history of using their credit card responsibly and making timely payments.

You stand a good chance of rebuilding your credit even if you are not liable for your debts. You only need to sit back and do nothing to benefit from being an authorized user, and you will benefit even if you do not use a credit card.

However, some credit card companies do not recognize authorized users in their credit reports. Also, ensure that the individual who makes you an authorized user on their credit card has good credit and excellent payment history.

(3) Obtain A Credit Card That Is Secured

The difference between a secured and an unsecured credit card is that you pay the issuer a deposit upfront for the secured card. Your lender can offer you credit using the deposit as collateral.

Your lender will charge interest and report timely payments to 3 top credit bureaus. So a secured credit card can help you rebuild your credit by establishing a good history of payments.

(4) Apply For A Credit Builder Loan

After bankruptcy, banks and other lenders may be more willing to offer you a credit builder loan. When you take a credit builder loan, money is held in a savings account until it gets to an amount that you both agreed to.

You only get your loan when the money reaches the agreed-upon amount. You will be borrowing your own money. Money that you keep stashed away will not help rebuild your credit but making payments for your credit builder loan certainly will!

(5) Report Payment For Other Information (e.g., Utility Bills and Rent)

Experian and some other companies can help rebuild your credit after bankruptcy through payments you made for utilities, rent, or phone bills. Adhering to your budget and making timely payments each month will boost your credit score.

(6) Apply For A Secured Credit Card After Filing Bankruptcy

Your credit rating will get a boost if you acquire a new credit card. After filing bankruptcy, numerous credit card issuers will flood your mail with offers to issue you a new credit card.

However, it would be best if you were very serious about these new offers because most credit card companies charge higher interest rates for individuals who have recently filed bankruptcy. After filing bankruptcy, if you get a regular credit card, stay away from card issuers whose annual fees are very high.

(7) Manage Your Debts Better By Establishing good Debt control Habits

Paying the whole balance may be impossible. Nevertheless, you should go out of your way and pay over the minimum monthly payments. Also, keep your credit utilization ratio in mind.

Ensure you keep your credit card balances below 30% of your total credit limit. Even if you have enough credit, exceeding this limit will lower your credit score.

Finally, you can stay on top of everything by ensuring that all debts are paid on time, and monitoring your credit is a must.

Repairing Credit After Bankruptcy Is An Ongoing Process - Continue Keeping Track Of Your Credit.

Credit repair after bankruptcy requires you to closely watch your finances and credit report. You can ensure that your efforts to repair and rebuild your credit are bearing fruit by keeping track of the process.

Luckily, you get a free copy of your credit report yearly from TransUnion, Experian, and Equifax. Visit annualcreditreport.com every 12 months for a free copy of your credit report.

Tracking your credit will help you monitor your progress in re-establishing a good credit rating on your credit report and help you find errors before they become a big problem. For instance, a bank may misreport your payment history. According to the Fair Credit Reporting Act (FCRA), you have a right to dispute all and any incorrect information found in your credit history.

Rebuilding Credit After Bankruptcy - The Bottom Line!

Rebuilding credit after bankruptcy is a possibility that can be realized through commitment and proactively following the above steps needed to establish a good credit history. Maintaining good credit will benefit you for the foreseeable future.

Free 5-Day - Start Repairing Credit Challenge - Do It Yourself - Including A Live Expert Question & Answer Session.

Related Articles:

- Credit Score After Bankruptcy – What to Expect

- Credit Repair After Bankruptcy: It Is Possible

- Better Credit Booster News and Tips

- 101 Credit Tips to Boost Credit Score Points, Today!

- Frequently Asked Credit Repair Questions and Answers- FAQ